OCBC Group, the multinational banking and financial services giant based in Singapore, has announced its plans to expand and grow in Southeast Asia, with a goal of boosting trade connections and wealth management in the region. The corporation aims to increase its revenue to SGD 3 billion or USD 2.22 billion by 2025.

Helen Wong, the Chief Executive Officer (CEO) of OCBC, outlined the bank’s strategy for achieving this target. She stated that OCBC plans to drive more investments in digital banking and other finance solutions in China over the next three years, amounting to SGD 50 million. This investment follows the SGD 140 million the bank has already dedicated to such initiatives over the past three years. Wong emphasized that OCBC has established a strong presence in both Southeast Asia and China and aims to capitalize on opportunities in these regions. She further noted that the ease in China’s restrictions post-pandemic opens up possibilities for ASEAN and other geopolitical aspects to support this potential growth. To enhance its operations, OCBC will adopt a twin-hub approach, with Hong Kong and Singapore leading the efforts to strengthen industries in Indonesia, Thailand, Singapore, Malaysia, and Vietnam.

Chinese Ambassador of ASEAN, Hou Yanqi, affirmed that bilateral trade between ASEAN and China has witnessed significant growth in recent years. The trade values surged from USD 641.5 billion in 2019 to USD 975.3 billion in 2022, reflecting the strengthening ties between the two regions.

As part of its strategic restructuring, OCBC Wing Hang Bank in Hong Kong will now be known as OCBC Bank (Hong Kong). Similarly, Banco OCBC Weng Hang in Macau has been rebranded as OCBC (Macao). Furthermore, OCBC Wing Hang Bank’s headquarters in China will be renamed OCBC Bank by the end of the year. These changes come as a result of OCBC’s acquisition of Wing Hang Bank in 2014, which aimed to expedite the bank’s integration in Macau, Hong Kong, and mainland China.

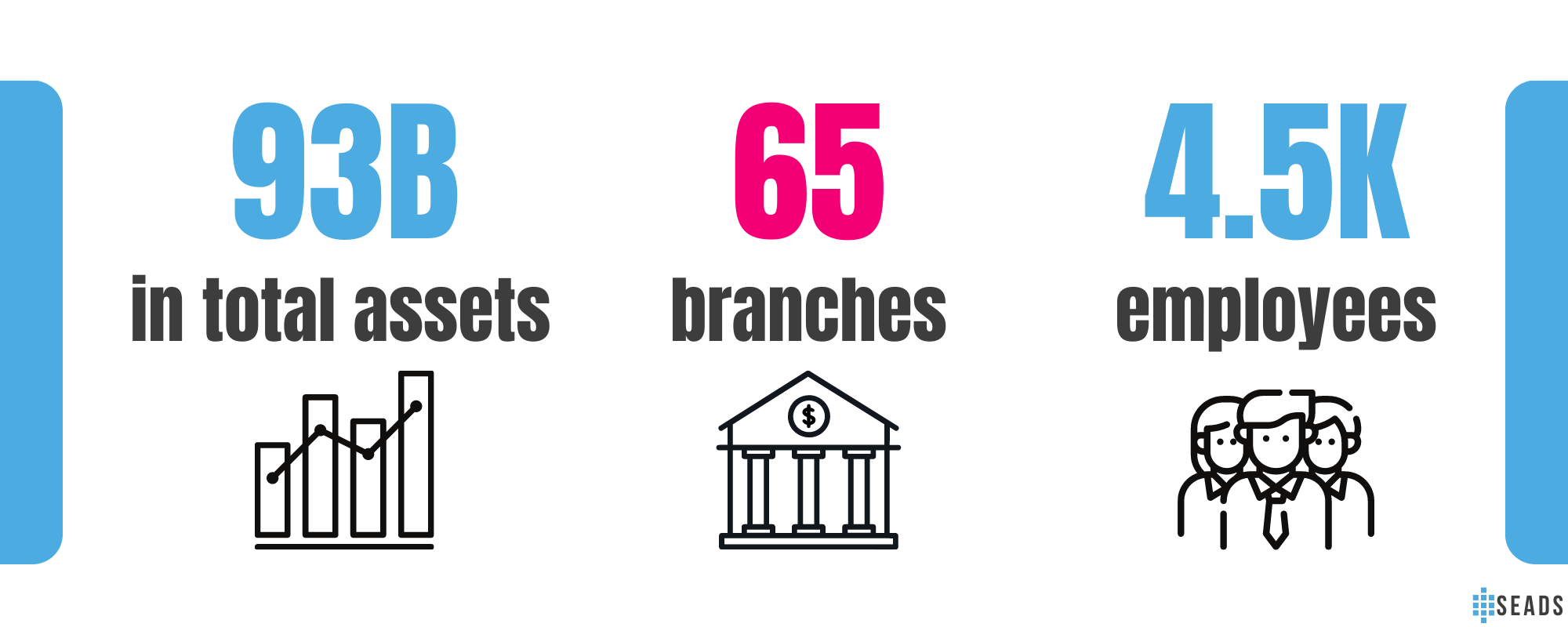

With total assets amounting to SGD 93 billion, OCBC Wing Hang Bank has over 4,500 employees and operates approximately 65 branches across 17 cities in China, Hong Kong, Macau, and Taiwan. The bank plans to increase its workforce by 30% in the coming months, expanding to 400 employees. It will also add relationship managers to support its private banking services.

Jason Moo, CEO of OCBC’s private bank unit, Bank of Singapore, shared the bank’s goal of attracting USD21 billion in fresh funds from clients to manage over the next three years. This move would bring OCBC’s total assets under management to USD 145 billion by 2025. Moo highlighted that the bank’s assets under management tripled between 2013 and 2022, mainly driven by mainland China.

Wong emphasized that OCBC is well-positioned to assist mainland Chinese firms in expanding into ASEAN markets and vice versa. She noted that despite international geopolitical tensions, it is crucial for countries to develop closer relationships with their neighbors. Wong expressed optimism about the growing closeness between China and ASEAN, predicting that they will become the fastest-growing regions worldwide.

As OCBC Group sets its sights on expanding its footprint in Southeast Asia and strengthening its presence in China, the bank aims to foster greater economic connectivity and capital flow between these regions, paving the way for enhanced trade and wealth management opportunities.