Based on a recent study of Global Banking Benchmark, which surveyed 1,000 senior bank executives worldwide, Southeast Asia is leaning towards accelerating digital transformation. With Covid-19 pushing everything online, businesses need to stay on top by understanding their customer base, which is why over a quarter of Southeast Asian banks are focused on customer experience as the primary driver towards achieving digital transformation.

Singapore, in particular, has a total of 24% of banks that are focused on customer experience. Enhancing customer experience involves maximizing the use of a variety of data sources to gain a more rich understanding of consumers. Banks believe innovation can help them better target their customers, with 26% of banks globally thinking this way.

In Southeast Asia, four out of ten banks believe technologies like data and analytics, artificial intelligence, and machine learning should be a priority. About 44% of banks in the region leaned on cloud computing for innovation. These improvements and developments are crucial to establish advanced banking systems will help with digital transformation.

They are leveraging data analytics, machine learning, and artificial intelligence to gain a deeper understanding of their customers. By analyzing customer data, banks can create customized solutions and experiences which meet their customers’ unique needs.

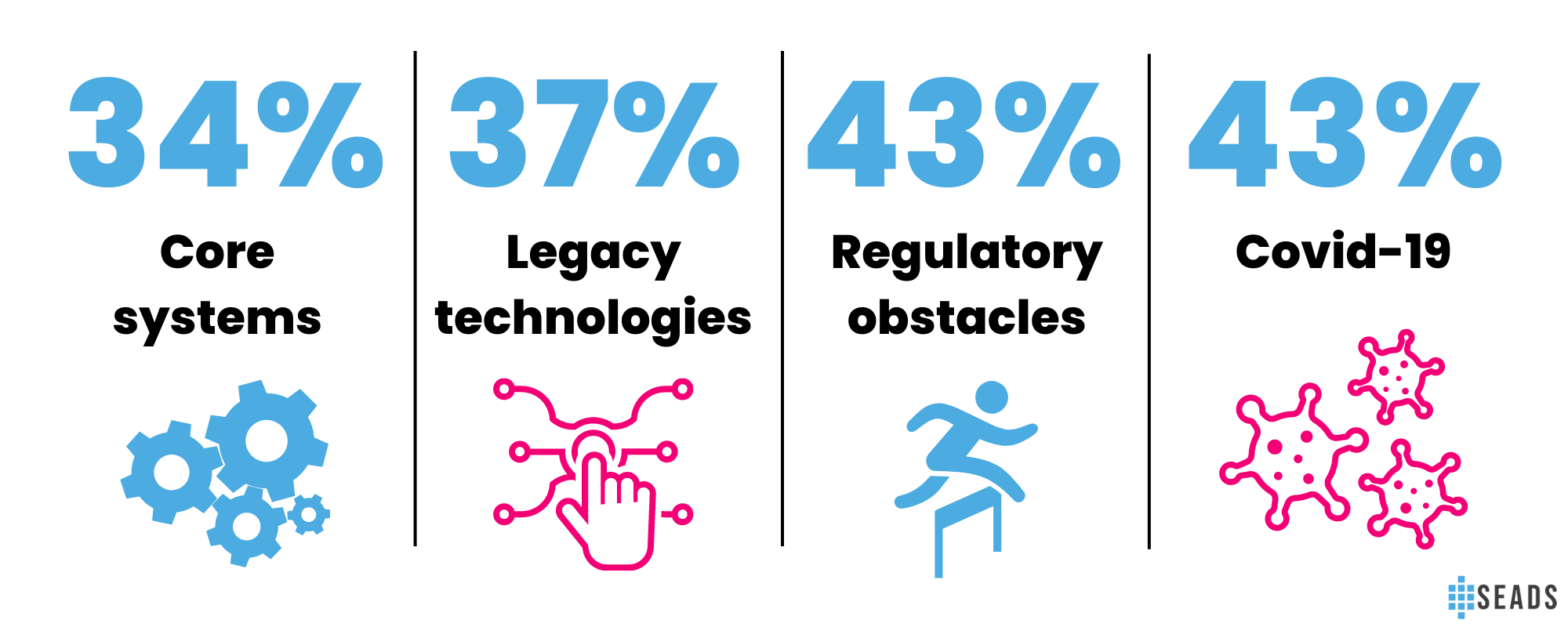

Despite this transformation, there are still hindrances causing the shift to slow down. The top barriers to digital transformation in Southeast Asia are:

- 34% core systems

- 37% legacy technologies

- 43% regulatory obstacles

- 43% Covid-19

However, the region still recognizes the urgency for the improvement of traditional banking and is continuing to overcome such challenges.

The survey revealed hyperpersonalisation has become one of the top priorities of banks in Southeast Asia. Hyperpersonalisation involves creating a personalized experience for customers through targeted marketing, product recommendations, and tailored services.

Hence, banks navigate through regulatory frameworks that are becoming increasingly digital-led. Banks need to ensure they are complying with regulations while leveraging new technologies to provide better services to customers.