As digital banking continues to take the financial industry by storm, the Asia Pacific (APAC) region has become a hotbed for the industry’s growth. Out of the 250 digital banks worldwide, 20% of them are situated in the APAC region, with Malaysia being one of the countries leading the charge. Bank Negara Malaysia (BNM), the central bank of Malaysia, shared five digital bank licenses to top players in the fintech industry, like the Boost-RHB Consortium, last April.

The success of the digital banking industry in Malaysia is due to the country’s emphasis on carrying out a profitable digital banking model. This model is evident in BNM’s assessment criteria, which focuses on the applicants’ credibility and integrity, the sufficiency of their financial resources, and the reliability and soundness of their business endeavors, as well as their capacity to bridge financial inclusion gaps. This criteria is made to back the goal of providing solutions to the financially underserved, but the issue is whether this will be profitable or not so there is a profitable banking model.

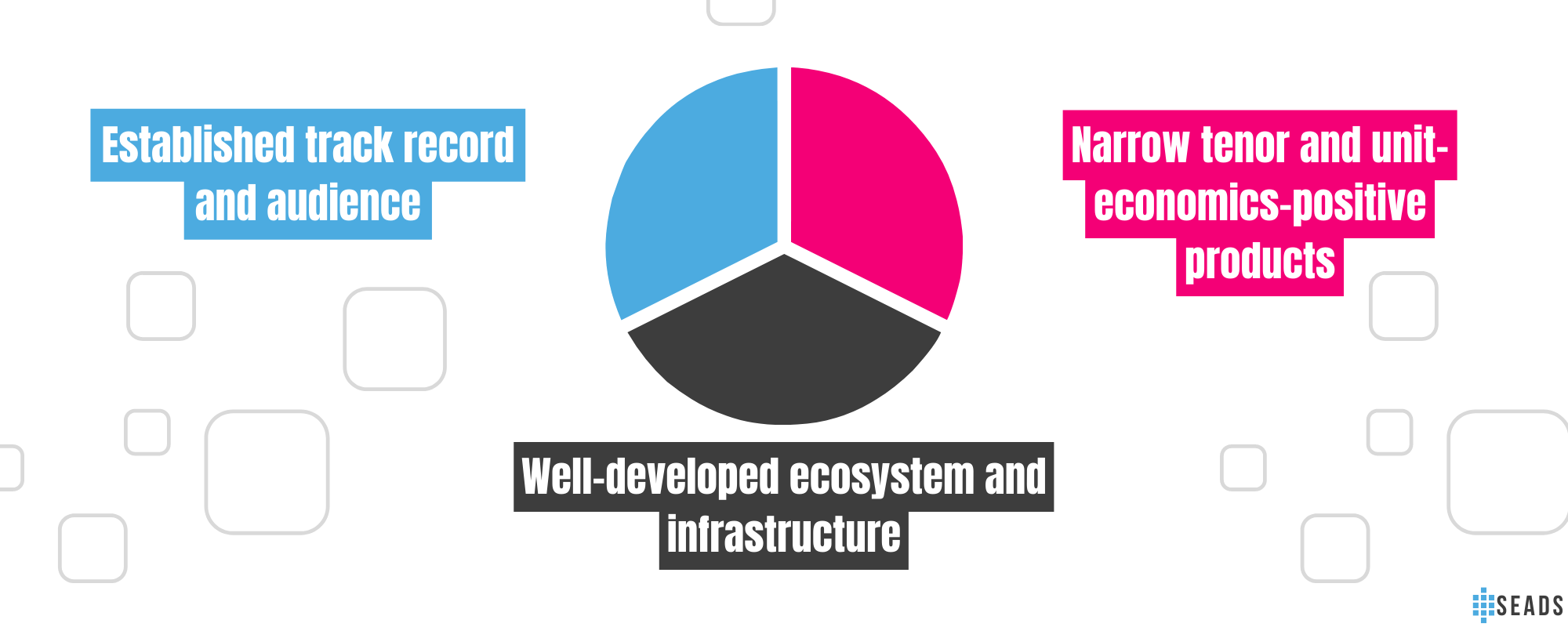

One of the leading industry players, Boost-RHB Consortium, uses a profitable banking model that has three parts.

1. Established track record and audience. Boost, as of 2022, has granted a value of about RM2.5 billion in loans both in Malaysia and Indonesia, an increase of 70% annually. There is also a 90% repeat rate on short-term loans last year. Boost constantly retains its record of single-digit non-performing-loan (NPL) rate, made possible because of their AI-leveraged processes in their lending operations.

2. Well-developed ecosystem and infrastructure. The model offers a lower customer acquisition cost. Initially, Boost started as an eWallet in 2017, and now it has expanded to offer more financial solutions such as AI-based lending, a centralized fintech app with around 10 million users in Malaysia, merchant solutions with more than 500,000 touchpoints in Malaysia and Indonesia, cross-border payment systems in 7 countries and more than a hundred digital partners.

3. Narrow tenor and unit-economics-positive products. Despite the challenges posed in the market, digital banks are predicted to remain resilient. Since then, Boost has already been offering integrated solutions with shorter tenors to ensure that the risk of huge asset-liability mismatches is not affecting the industry.

To sum up, Malaysia’s digital banking industry is experiencing rapid growth, with the country’s emphasis on a profitable digital banking model that prioritizes financial inclusion. Boost-RHB Consortium has established itself as a leading player in the industry. With its successful business model, Boost is set to continue leading the way for the industry’s growth, not only in Malaysia but also in other countries looking to expand their digital banking capabilities.