The Bangko Sentral ng Pilipinas (BSP) has announced ambitious plans to digitize at least 50% of all transactions and increase the number of Filipinos using digital payment systems to 70%. This comes as the country continues to grapple with the ongoing pandemic, which has driven many people to turn to online payments as mobility restrictions increase.

BSP Governor Felipe M. Medalla has said that the goal of increasing both the volume and value of digital transactions is heading in the right direction, thanks to the growing popularity of e-wallets and additional integration. To support this, the central bank has recently issued Circular No. 1055, which requires payment service providers to start using QR codes for seamless transactions.

In addition to this, the BSP has also introduced a number of measures to encourage the adoption of digital payments among small and medium-sized enterprises (SMEs). These include the QR-Ph and QR P2M facility for person-to-merchant payments, as well as the Paleng-QR Ph Plus for mobile payments to bicycle and jeepney drivers, and market vendors.

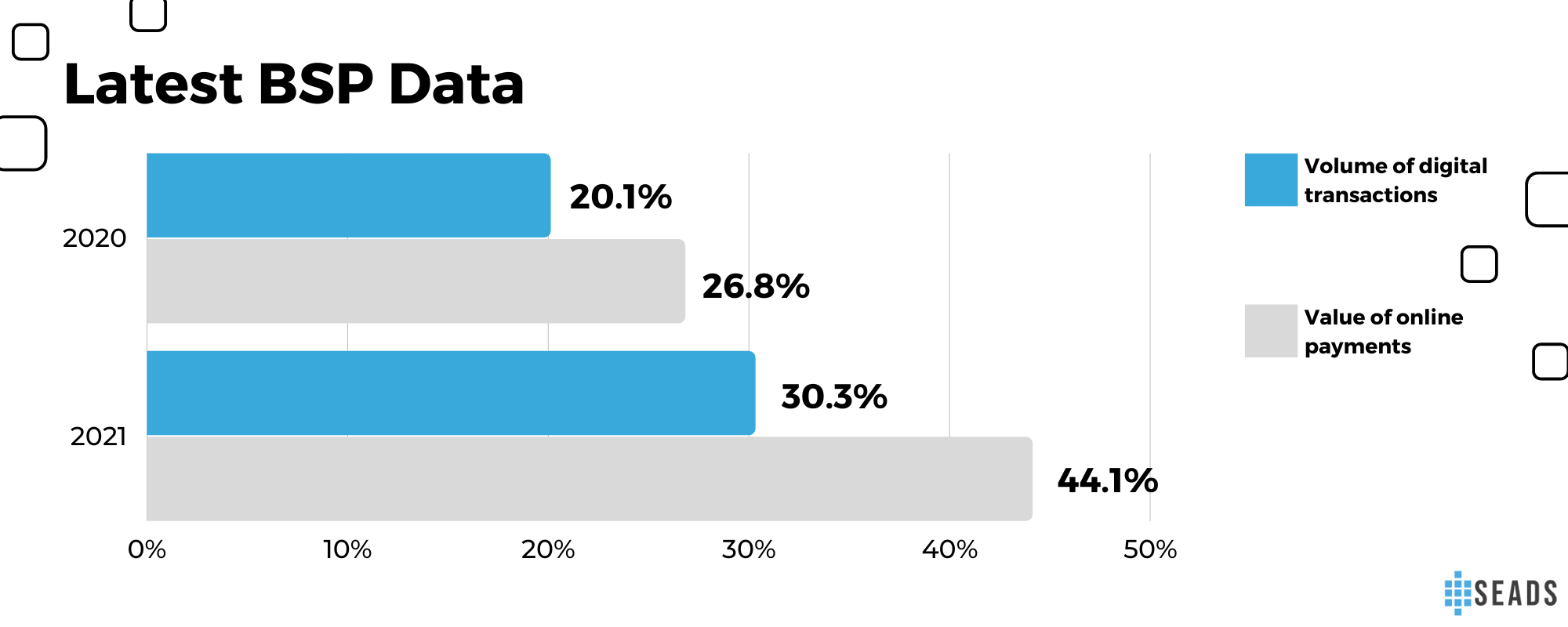

Latest data from the BSP shows that the volume of digital transactions has risen from 20.1% in 2020 to 30.3% in 2021, while the value of online payments has gone from 26.8% in 2020 to 44.1% in 2021. This increase in digital payments is being attributed to the accelerated use of mobile devices, better internet access, the introduction of transfer facilities like InstaPay and PESOnet, and national QR codes.

Manish Bhai, the President and CEO of UNO Digital Bank, has said that with all these government initiatives driving people towards a more digital-driven world, digital payment systems in the Philippines have significantly increased. He added that next to Thailand and Indonesia, Philippines made one of the highest digital payments in Southeast Asia. However, he also noted that while there is still a lot of work to be done, the goal is to bring 70% of the Philippines’ adult population to using digital payments and increase the 10% of people borrowing from financial sectors.

However, all of this will only happen with confidence and trust in the systems in place. It may take time to establish these systems, but the BSP is determined to achieve its goal of digitizing at least 50% of all transactions and increasing the number of Filipinos using digital payment systems to 70%.