Additiv’s APAC General Manager, Pieter Zylstra, shared an insightful presentation during the Hubbis Indonesia Wealth Management Forum last month, highlighting how digitalization has been driving the wealth and expansion of businesses in the region.

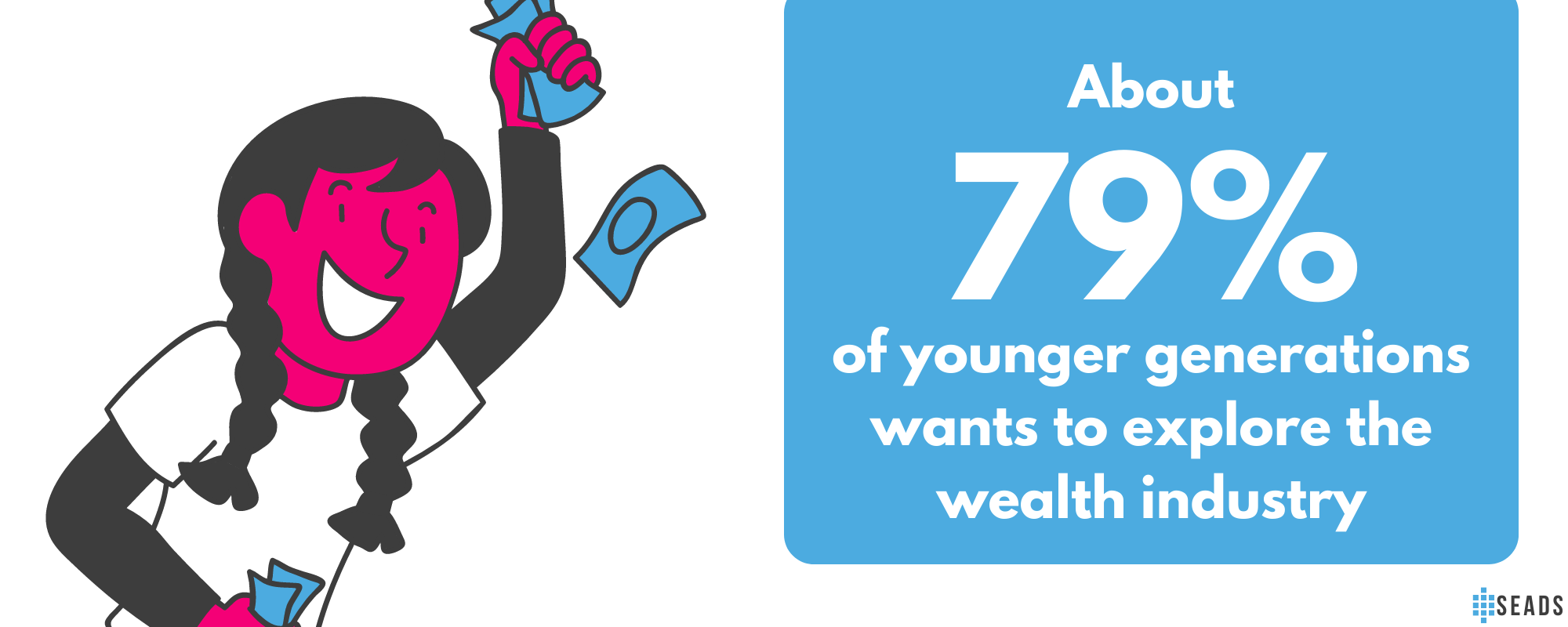

Zylstra noted that embedded wealth is promising in Indonesia, with a significant focus on growing the wealth industry by the younger generation, mostly millennials and Gen Zs. About 79% of the younger generation is keen on exploring the wealth industry, with about 57% of those aged between 18 and 30 joining in.

The phenomenon of embedded wealth is not limited to Indonesia alone, as it has become a global trend due to changes in the value chain and how businesses handle and deliver financial services.

Additiv’s research also shows emerging trends in Indonesia towards orchestrated and embedded finance, with Southeast Asia region showing great interest towards non-banks as providers of financial solutions, with super apps like Grab being one of the leading players.

While this interest on orchestrated and embedded finance is not yet evident in areas like America and Europe, it is already starting to emerge in Southeast Asia. Additiv’s research shows that the region’s digital banking will be mainly composed of embedded banking and finance, and open banking.

Traditional and domestic banks are also continuously making efforts to adapt to this digital economy, and one of their strategies is transforming their mobile banking to lifestyle apps, like Genius and Livin. In the near future, these apps could become separate brands, as embedded finance comes with many positive implications, such as access to cheaper financial services and elevated experiences.

Additiv’s wealth orchestration platform is set to help leading players manage an array of digital wealth solutions directly to their customers or through middlemen or distributors. Wealth managers, IFAs, asset managers, insurance companies, consumer platforms, and neo-banks are the stakeholders that would see the most benefit with the improvement and innovation happening in wealth management. They can offer more digital products and services, improve customer satisfaction by providing lifetime value and loyalty.

The Southeast Asia region’s interest in embedded finance and orchestration is an exciting development for the wealth management industry. It opens up new opportunities for businesses to explore and innovate.

With the rise of digitalization, wealth management solutions are becoming more accessible and personalized than ever before, and additiv is at the forefront of this digital transformation.

The company’s wealth orchestration platform is an excellent example of how businesses can leverage technology to provide better wealth management solutions and experiences to their customers.